When Is It Proper to Use a Small Estate Affidavit?

Heirs can use a small estate affidavit to transfer property without a formal probate only in situations when:

- The deceased person died without a Will;

- At least 30 days have passed since the date of death;

- No person has filed an application seeking appointment as personal representative of the estate;

- The value of the probate estate is $75,000 or less, excluding the value of the homestead and other exempt property; and

- The total assets (excluding homestead and exempt property) exceed the total known debts of the estate (excluding debts secured by homestead and exempt property).

Which Situations Qualify for a Small Estate Affidavit?

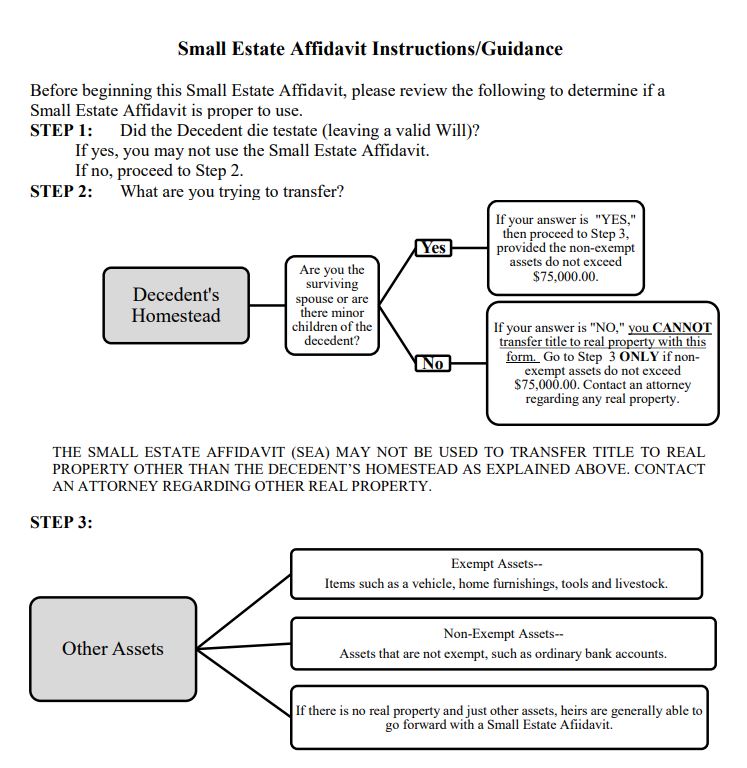

The Harris County Clerk’s office created a useful flowchart to help Texans determine whether a small estate affidavit is proper:

Can I Use a Small Estate Affidavit to Transfer Real Estate?

It is only possible to transfer real estate using a small estate affidavit if the property was the decedent’s homestead and the decedent is heirs are a spouse or minor children.

If the property was not a homestead and the heirs are not a spouse or minor children, it is not possible to use a small estate affidavit to transfer real estate.

What are Exempt Assets in Texas?

According to Section 42.001 of the Texas Property Code, exempt assets for a married decedent include a homestead for the use and benefit of a surviving spouse or minor children and up to $100,000 worth of personal property that will be used for the benefit of a surviving spouse, minor children, unmarried children who were living in the decedent’s home, and incapacitated adult children.

If the decedent was single, personal property worth up to $50,000 is considered exempt property.

Section 42.002 lists the following examples of exempt personal property: E

- Home furnishings, including family heirlooms

- Provisions for consumption (food and ingredients)

- Farming or ranching implements and vehicles

- Tools, equipment, books, and apparatus including boats and motor vehicles used in a trade or profession

- Wearing apparel (clothes)

- Jewelry in an amount that does not exceed 25% of the $100,000 and $50,000 limits mentioned above

- Two firearms

- Athletic and sporting equipment, including bicycles

- Vehicles for each member of a family or single adult who holds a driver’s license (or relies on someone else with a license

- Certain livestock (two horses, mules, or donkeys with a saddle, blanket, and bridle for each, 12 head of cattle, 60 head of other livestock, 120 fowl

- Household pets

Pension benefits, retirement assets and insurance benefits are also exempt.

Estate vs. Probate Estate

Note that the $75,000 limit pertains only to the value of a decedent’s probate estate, not the gross estate. The probate estate consists of property titled in the decedent’s name, excluding value of the homestead. It does not include assets placed in trust. It also does not include assets that transfer by payable-on-death accounts, transfer on death designation, or beneficiary designation.

So suppose a decedent had a $500,000 life insurance policy and a $300,000 retirement plan. If he named has wife has the beneficiary, and the value of his remaining assets, excluding his homestead, do not exceed $75,000, his estate might still qualify for small estate administration.

Do I Need to Hire a Lawyer to File a Small Estate Affidavit?

It is not necessary to hire a lawyer to file a small estate affidavit. In fact, many probate courts provide forms on their website for the public’s use. For example, Harris County provides a very good small estate affidavit form (pdf), as well as detailed instructions for filling it out.

Once the affidavit is complete, you should file the affidavit with the probate court. The Court will review the affidavit to confirm that it complies with the statutory requirements. If the Court approves the affidavit, the heirs can use a certified copy of the affidavit of the estate to collect money the estate is owed or assets the estate owns.

This article was originally published on March 3, 2017, and updated on August 9, 2023.

Comments

Cheryl Woods

December 26, 2017 at 11:26am

My father passed on in 2002. My 84 year old mother has been diagnosed with dementia and has no will. Can she legally complete one now, or even make one of her five children the executor of her estate. She has five children and an extensive amount of property.

Rania Combs

December 31, 2017 at 2:37pm

In order to sign a Will, a testator must have testamentary capacity, which means that the testator have the mental ability to understand: the business in which he/she is engaged, the effect of making a will, the nature and extent of his/her property; the persons who are the natural objects of the testator’s bounty; the fact that he/she is disposing assets; and how all these elements relate so as to form an orderly plan for the disposition of the testator’s property.

Annette Rosas

February 18, 2019 at 11:52am

My mother recently passed away with no will she isn’t married and had only my brother and I. Currently I live in her home as I moved in about 6 months ago to take care of her. She basically has her home and car. What would I need to file and/or do?

Thank you

Rania Combs

February 19, 2019 at 12:54pm

I’m sorry for your loss. The Texas Young Lawyer’s Association has a publication that may answer many of your questions: The Texas Probate Passport.