What Happens If You Die Without A Will in Texas?

If you die without a Will in Texas, your property will pass according to a predetermined formula created by the state legislature that doesn’t take into account your wishes or unique circumstances.

Having a Will gives you the freedom to decide who receives your property after you die. But Texas’ inheritance laws, known as the intestacy statutes, are rigid. They are simply the legislature’s best guess about how an average deceased Texan would want to divide their property after they die. And sometimes they result in a distribution that is neither fair nor equitable.

Below is a summary of the statutory rules that control who receives your property if you die without a Will in Texas, along with quick links to take you to the information you are seeking.

- What happens if you are you a single person without children?

- What happens if you are you a single person with children?

- What happens if you are you married?

Who Inherits Property When a Single Person With No Children Dies Without a Will in Texas?

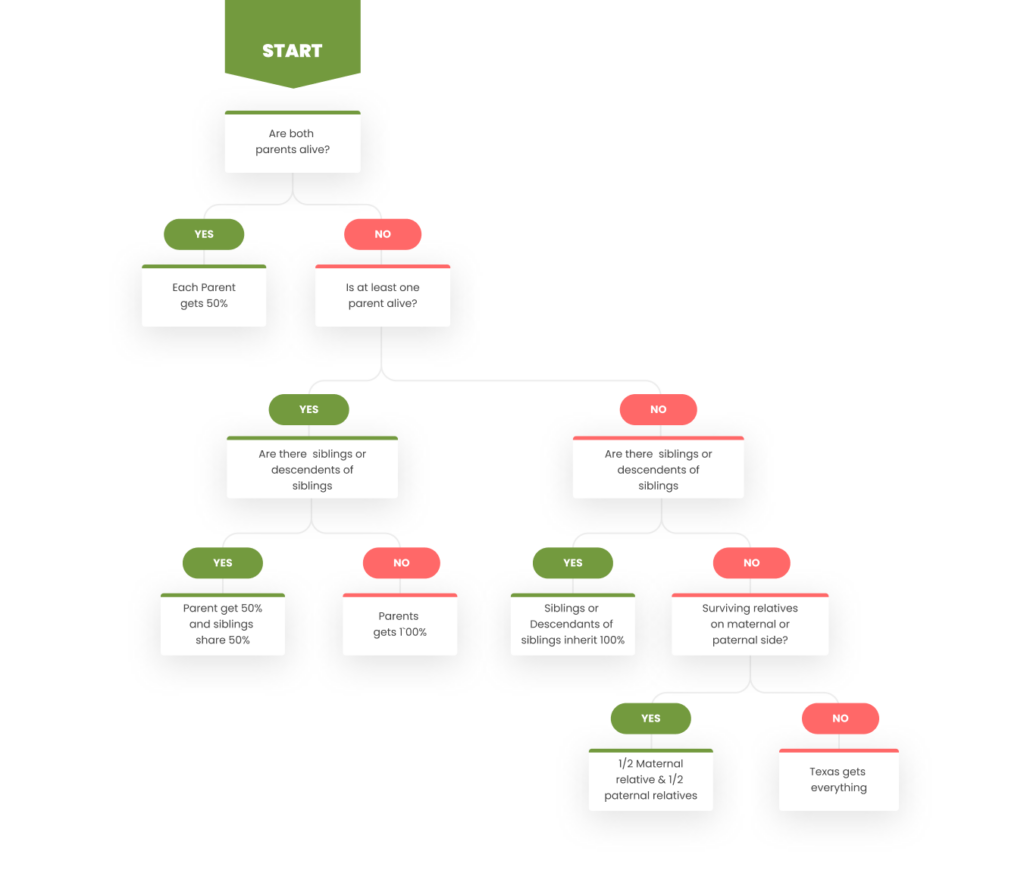

If a you are single and die without a will in Texas, your property will pass as follows:

- Your property will pass equally to your parents if both are living. If one parent has died, and you don’t have any siblings, then your estate will pass to your surviving parent.

- However if you do have siblings or descendants of siblings (nieces and nephews), then your surviving parent would receive only half of the estate. Your siblings and descendants of deceased siblings would share the remaining one-half.

- All of your estate would pass to your siblings or their descendants if you have no surviving parents.

- If you have no surviving parents, siblings, or descendants of siblings, then your estate will be divided into two halves. One half will pass to relatives on your mother’s side. The other half will pass to relatives on your father’s side.

- If one side of the family has died out, the surviving side of the family would inherit your entire estate.

- On rare occasions, when an unmarried person dies without any surviving heirs, his estate will pass to the State of Texas.

For some, this manner of distribution listed in the Texas intestacy statutes may mimic what they would have chosen. But not always.

For example, I recently received a phone call from someone whose boyfriend had just died. They had purchased a home together. Since both their names were on the deed, they assumed the survivor would inherit their home if one died.

But in Texas, simply purchasing a home jointly, even between spouses, doesn’t create a right of survivorship unless the deed specifically says it does. Since they were not married and the deed did not create a right of survivorship, her boyfriend’s share of the home passed to his legal heirs, not her.

Who Inherits When a Single Person with Children Dies Without a Will?

If you are single, have children, and die without a Will, all your property will pass to your descendants. If your descendants are of the same degree of relationship, (meaning, for example, all are your children or all are your grandchildren), then they will each receive an equal share.

However, if your descendants are of different degrees of relationship, (meaning some of your children survive while others predecease you, leaving children or grandchildren of their own), then the younger generation will inherit only the share the older generation would have received had he or she survived.

For example, supposed you had three children. If all three survive you, then each will receive 1/3 of your estate. If one dies before you, but has two surviving children, then the two surviving children would inherit 1/3, but the children of the deceased child would split their parent’s share. However, suppose all the children predecease you, and 6 grandchildren in total survive you. In that case, each grandchild would receive 1/6 of your estate.

Who Inherits When A Married Person Dies Without a Will in Texas?

If you are married and you die without a Will in Texas, how much property your surviving spouse receives will depend on whether the property is community property or separate property.

Community Property

In Texas, there is a presumption that all property you acquire during a marriage is community property, unless you received it as a gift or inherited it.

The intestacy statutes provide that your surviving spouse will inherit all of your community property if you don’t have any children. However, if you die without a Will in Texas and your spouse and children survive you, then:

- Your surviving spouse will inherit all your community property if all your children are also your surviving spouse’s children;

- I you have children from another marriage, all your one-half interest in community property will pass to your children. Your spouse only keeps his or her one-half interest.

Dying without a Will in Texas can be problematic in blended families because it may result in the surviving spouse not having full ownership of the couple’s homestead.

Separate Property

Separate property is property that you owned before marriage, or acquired, even during a marriage, by gift or inheritance. The formula for who inherits the separate property of a married people who die without a Will in Texas depends whether on they had children and whether the property is real estate or personal property.

- If your spouse and children survive you, your surviving spouse will receive one third of your separate personal property. However, your surviving spouse will only receive a life estate (the right to use the property until his or her death) in one-third of your separate real property. Your children would inherit the remaining interest outright.

- If you are married, but don’t have descendants, your surviving spouse will receive your separate personal property. However, if you have surviving parents and siblings, your surviving spouse will receive only one-half of the separate real property. The other half will pass to your parents, siblings or descendants of siblings according to a statutory formula.

You can learn more about the requirements of a valid Will in Texas by clicking on the link.

Do Intestacy Laws Control All Property if You Die Without a Will in Texas?

Although Texas intestacy statutes play a crucial role in directing who will inherit your property if you die without a Will in Texas, they do not apply to non-probate assets.

Non-probate assets typically include:

- Jointly Owned Property with Right of Survivorship: Real estate, bank accounts, and other assets owned jointly with another individual where the right of survivorship is explicitly stated. Upon the death of one owner, the surviving owner automatically assumes full ownership of the property.

- Retirement Accounts: IRAs, 401(k)s, and other retirement accounts that have designated beneficiaries will pass directly to those beneficiaries.

- Life Insurance Policies: Named beneficiaries will receive the proceeds from life insurance policies regardless of whether a Will exists.

- Payable-on-Death (POD) and Transfer-on-Death (TOD) Accounts: Certain financial accounts and securities allow the account holder to name a beneficiary who will receive the assets upon the account holder’s death.

These types of assets will pass to identified beneficiaries by operation of law, or by designation, regardless of whether a Will exists.

This post was originally published on October 18, 2010, and updated on March 15, 2024.

Comments

Tweets that mention What Happens If You Die Without a Will – Texas Wills and Trusts Online -- Topsy.com

October 18, 2010 at 3:40pm

[…] This post was mentioned on Twitter by Rania Combs, Daina L. Babin. Daina L. Babin said: RT @raniacombs: Dying Without A Will: The #Texas Intestacy Statutes https://bit.ly/ahw0qA […]

Twyla

April 19, 2012 at 6:14am

MY BROTHER HAS BEEN MARRIED AND HAS SOME SURVIVING STEPCHILDREN, BUT HE WISHES TO LEAVE HIS ESTATE TO HIS SIBLINGS, WOULD THOSE STEPCHILDREN HAVE ANY RIGHT TO THE ESTATE UNDER TEXAS LAW?

Rania Combs

April 19, 2012 at 1:17pm

No. Stepchildren are not entitled to inherit from a stepparent’s estate under the Texas intestacy statutes.

charlene

April 8, 2016 at 2:13pm

My uncle passed away no children and no spouse….

He has a will…

How can I get ownership of his house…

Harris county, Texas

Rania Combs

June 16, 2016 at 8:53am

Please accept my condolences for your loss. The following article may provide you with resources to answer your question: What To Do When Someone Dies In Texas.

Victoria

July 10, 2012 at 1:13am

My grandfather has been paying the taxes on an acre of land that belonged to his deseased wife. He has been paying the taxes for over 10 years. They have no children but she has children from a previous marriage. He has never had any problems with them wanting the land until recently when they wrote him a letter. She left no will. He has all the paperwork proving that he has paid the taxes on the land for the past 10 or more years. I know the land is classified as “homestead land.” Would this be considered community property or personal property?

Rania Combs

July 12, 2012 at 1:00pm

If property is acquired before marriage, or by gift, devise or descent, the property would be separate property.

Kelsi

July 11, 2012 at 9:44pm

My father passsed away without a will in Texas..I am wondering what will happen…my stepmom is still living and I have 2 grown stepsisters and 1 full brother. Will everything go to her? She also has cancer and she has a will leaving everything to my brother and I…not my stepsisters…she has been trying to sell some things and my brother and i are having to sign papers that we are not contesting the sale…what does that mean?

Rania Combs

July 12, 2012 at 12:12pm

Thanks for your question. The following article explains the intestate distribution scheme in situations involving blended families: The Complexities of Intestacy in Blended Families.

Daniel

August 6, 2012 at 10:18am

What happens if a couple dies, and one spouse has a will, but the other does not? They have surviving children, and no stepchildren.

Thanks.

dan

Rania Combs

August 6, 2012 at 3:29pm

The estate of the spouse who died testate will pass according to the terms of the will, while the estate of the spouse who died without a will would pass according to the intestacy statutes.

Bianca Delgado

December 22, 2012 at 5:39pm

Does the state automatically start the process on distributing the assets if there is not will? Or what do I have to do in order to get the process going on the distribution of assets?

Rania Combs

January 2, 2013 at 10:51am

It depends on what type of assets the estate contained. It may be that all the estate’s asset were non-probate assets, such as insurance policies and retirement plans. Those assets pass outside the will through beneficiary designation with no requirement of probate. If the estate contained assets that require probate, the type of proceeding will depend on the size of the estate. A small estate affidavit may be all that is required for small, uncomplicated estates, while a determination of heirship proceeding may be necessary for larger, more complicated estates.

Rania Combs

January 2, 2013 at 2:56pm

The state does not initiate any distributions. The process will depend on the size of the estate and the type of assets it contains.

Cory

December 24, 2012 at 6:45pm

My stepfather recently passed away without a will. The only assets are their home, purchased together, a death benefit from his employer equal to his salary during his last year of employment (approx 48K). I have 3 stepbrothers. Will they receive half of the death benefit from the employer? And if we sell the house, they will be entitled to half the proceeds? They have mentioned that they want my mother to have everything, but I assume we would need to get this in writing? Thanks for any help…

Rania Combs

January 2, 2013 at 10:36am

Thanks for your question, Cory. Please accept my condolences for your loss. The following article will discusses intestacy in blended family situations: The Complexities of Intestacy in Blended Families. Non-probate assets, such as 401Ks and insurance policies, pass by beneficiary designation rather than through the will.

Terry Lee

December 28, 2012 at 9:59am

My brother passed away last Sunday and left no will that I can find. He was living with his girlfriend for 13 years as husband and wife. He has two children from a former marriage which he has not seen for over 20 years and no one knows their whereabouts.

Who qualifies as executor and beneficiary of his estate?

Rania Combs

January 2, 2013 at 10:24am

Thanks for your question, Terry. Please accept my condolences for your loss.

Since your brother died without a will and did not name an executor, the court will appoint a personal representative of the estate. An application for the appointment of an administrator can be combined with an application for probate, and a person interested in either the probate of the will or the appointment of a personal representative can apply for both.

Rae

December 31, 2012 at 1:31pm

My husand passed away in October. We have one child. He has one child from a previous marriage. What is his child entitled to? What are his parents entitled to, as they are trying to take everything they can from me

Rania Combs

January 2, 2013 at 10:15am

Thanks for your question, Rae. Please accept my condolences for your loss. The following article will discusses intestacy in blended family situations: The Complexities of Intestacy in Blended Families.

James

January 9, 2013 at 10:58pm

Is there a statute or a part of the constitution that gives a surviving spouse a right to occupy homestead real property of the deceased.

Rania Combs

January 9, 2013 at 11:21pm

Article 16, Section 52 of the Texas Constitution gives the surviving spouse a life estate in the homestead.

Will The State Get All My Assets If I Die Without A Will?

May 29, 2013 at 12:43pm

[…] If you die without a Will, your assets will be distributed to your heirs according to a statutory formula. You can learn more about Texas’ rules of descent and distribution by reading Dying Without a Will: The Texas Intestacy Statutes. […]

Toni

December 1, 2014 at 6:55pm

My father just recently passed away, we can not find his handwritten will. My younger sister and I are his only biological children. He was not married. Do we have to go through probate?

Thank you.

Rania Combs

December 8, 2014 at 12:28pm

Please accept my condolences for the loss of your father.

Whether or not you will need to go through some type of probate proceeding will depend on what type of property was in your father’s estate. For more information, read: Is Probate Always Necessary?

John

December 5, 2014 at 1:16am

My father died without a will in Texas. His children are spread out among the states; but one is still in Texas. He has no property, but he has money in a bank. We don’t know if he has debts.

If he does would his children be responsible for them?

Rania Combs

December 8, 2014 at 12:35pm

As long as none of the children are a party to the debt, the children will not be personally responsible for the debt. Generally, it is the deceased person’s estate that will be responsible to pay any outstanding debt.

Autumn

January 26, 2015 at 5:16pm

My father passed away three years ago without a will. I did not receive any money from either of his life insurance policies. My stepmother has all of his assets. Shouldn’t I have received 1/3 of his insurance policies?

Rania Combs

January 31, 2015 at 3:25pm

Insurance policies pass by contract to the person identified as the beneficiary of the policy.

Steven Jimenez

September 12, 2015 at 2:59pm

Is there a way to find out who the beneficiary of the policy was? My father passed away a month ago and was going through a divorce with my step mom. Apparently she’s having trouble accessing the money. I appreciate you taking the time to respond to everyone questions Rania Combs.

Rania Combs

September 18, 2015 at 5:26pm

You should probably start by contacting the insurance company who insured your father and informing the company that your father has died. The insurance company will then send a letter to the beneficiary with instructions explaining how to file a claim.

Nicole

January 30, 2015 at 5:47pm

My father just passed away in December and although we know there is a will, we can’t find it. How long can you wait to start the probate process? We’d like to give ourselves time to locate the will before we have to go through the process without one as he has children from a previous marriage and it is a more complicated probate procedure.

Thank you.

Rania Combs

January 31, 2015 at 3:09pm

I’m sorry for your loss, Nicole. The Texas Probate Code requires that a will be probated within 4 years of a testator’s death. For more information, read: When Should I Probate a Will?

Nancy

April 9, 2015 at 9:26pm

My father just passed away and I don’t think he had a will. My name is on his checking account but I’m not sure what rights that might give me. He was not married and I was the only child of his that spoke to him. How do I go about finding out if I were to able to take over his home or not?

Rania Combs

April 14, 2015 at 4:23pm

Please accept my condolences for your loss, Nancy.

When someone dies without a Will, their assets are distributed according to a statutory formula, which I outline in this article.

There are some assets, such as bank accounts with a pay on death designations, or insurance policies with beneficiary designations, that will pass to the beneficiaries identified. Additionally, accounts held as joint tenants with rights of survivorship will pass to the survivor of the account.

John

April 29, 2015 at 2:21pm

Hello. My mother passed away a month ago. I found a will that was made before she divorced. The will lists stepchildren that have no relation to her as beneficiaries. Do they have any claim on my mothers money?

Rania Combs

April 30, 2015 at 1:12pm

Please accept my condolences for your loss. Section 123.001(b) of the Texas Estates Code specifically addresses this issue. It provides that if a testator divorces, the entire Will is read as though the former spouse, and relatives of the former spouse who are not relatives of the testator, predeceased the testator.

Alicia

May 6, 2015 at 5:11am

My mother recently passed away. I was told that she had a will, but I can’t find it for the life of me. My mom did NOT want my sister to get ANY money as all of her friends would agree. Is there any way to fight for more of her estate?

Rania Combs

May 8, 2015 at 10:58am

Please accept my condolences for your loss.

Unfortunately, the intestacy statutes are rigid and inflexible. Without a Will, her assets will pass according to a statutory formula that doesn’t take into account her wishes.

Melissa

June 3, 2015 at 1:25pm

My father died 13 years ago without a will. My mother kept the home they purchased together during their marriage in both their names. She is no longer able to maintain the home and wants to move in with me (daughter). Does she need to have something in writing from all three of her children in order to do sell her home in Texas?

Rania Combs

June 3, 2015 at 3:59pm

Your question depends on whether your father had children who were not also your mother’s children.

In Texas, if someone dies without a Will and is married with children, the surviving spouse will inherit the deceased spouse’s one-half share in the community property if all the children of the deceased spouse are also the children of the surviving spouse. Otherwise, the deceased spouse’s one-half interest in the community estate will pass to his his or her children, with the surviving spouse keeping only his or her one-half interest.

Sunnye loftin

December 19, 2015 at 6:04pm

Can the children of the deceased force the spouse to sell? Spouse was planning to sell until he found out he would only get half and his parents have paid their debt in order that he keep house proceeds from the deceased spouse’s children.

Rania Combs

December 31, 2015 at 6:47pm

The following article may answer your question: Can Stepchildren Force a Surviving Spouse to Sell Homestead Property?

Jackie

June 3, 2015 at 3:41pm

My mother died in June of 2013 from cancer with no will. She was married, had two sons from previous marriage and a me with her current husband. No probate was filed. My dad died in December of 2014 unexpectedly with no will, widowed, two stepsons and me, his daughter. I’m trying to figure out the next steps. All they owned was a small piece of land and lots of bills (medical mostly). Where do I start and what do I need to do to get that small piece of land in my name? Also is there a time frame?

Rania Combs

June 3, 2015 at 3:47pm

The Texas Young Laywers Association has an informative document titled “The Texas Probate Passport.” It may help answer many of your questions. You can read it by clicking on the link.

Myra Cosgrove

June 18, 2015 at 10:08pm

my husband and have, between us, five children. Do we need a lawyer to write a will or can we print one off Internet and do it ourselves if we have it notarized and stored safely? And if we don’t write a will would our estate be divided among the children.

If one of us dies before the other, will the surviving spouse inherit all. Or would the surviving spouse inherit 1/2 with the other half being divided among all five children?

Rania Combs

June 22, 2015 at 11:23am

Hi Myra,

Thanks for your question. You mention you and your husband have five children between you, which suggests you are part of a blended family. Based on that information, I think it is crucial that you engage an attorney to assist you with your estate planning.

DIY planning is fraught with risk. The following articles explain some of the risks of DIY Estate Planning:

The Problem with LegalZoom and Other Do-It-Yourself Estate Planning Solutions

LegalZoom vs. Lawyer: What You Don’t Know Can Hurt You

Why Do People Use Lawyers To Prepare Their Wills?

Do It Yourself Estate Planning Mistake Disinherits Child

Attorneys don’t simply fill out forms. They analyse your circumstances, explain the ramifications of your choices and create documents that address your unique needs.

Rick anderson

August 6, 2015 at 11:14pm

My ex brother in law just died. He and my sister had 2 children during their marriage. They had been divorced about 2 years before his death. Neither one had remarried and we have found no will. Who would be entitled to his estate?

Rania Combs

August 18, 2015 at 1:55pm

The Texas Intestacy Statutes provide that if a single person dies without a Will and has children, then all property will pass to the deceased person’s descendants. If the descendants are of the same degree of relationship, then the assets will be divided equally between them.

Misty

August 12, 2015 at 8:50pm

Thank you so much for this webpage and your helpful answers to everyone. My mother is in hospice care with stage IV cervical cancer and never got around to writing her will. She is now almost bed-ridden, so it looks like she will probably end up dying without one. She is not married and I am her only child. Will it still be a lengthy hassle to have her home and vehicles put in my name? Will an heirship proceeding be necessary, since I am the only child? When the time comes, where should I start first–do I need to petition to administer her estate? I am aware of the existence of small estate affidavits, but I do not yet know if her estate is worth more than $50,000 once her bank account, vehicles, and jewelry are taken in account.

Rania Combs

August 18, 2015 at 12:53pm

Dear Misty,

I’m sure this has been a very difficult time for you. The following article from the Texas Young Lawyers Association may answer many of your questions: The Texas Probate Passport.

Rania

wanda

August 16, 2015 at 10:45pm

Hi My mother passed away sudden and was divorced but left no will or power of attorney. There are 4 of us adult kids and we are all on the same page of selling her car. How will we do this with out a sign title. We live in Texas. Thanks for your help

Rania Combs

August 18, 2015 at 12:41pm

The following article may help: Is Probate Necessary to Transfer Title to a Vehicle?

will

August 18, 2015 at 12:35am

My father died without a Will. He wasn’t married but had a minor child and an adult child. He had insurance. Are the children entitled to the proceeds of the insurance policy?

Rania Combs

August 18, 2015 at 12:40pm

Beneficiary designations control who will receive the proceeds of an insurance policy. However, if no beneficiaries are designated, then policy provisions will dictate how the benefits will be paid. Often, the benefits become part of the decedent’s estate and will be distributed according to the Texas Intestacy Statutes if there is no Will.

JR

August 24, 2015 at 2:43pm

Rania,

Thanks for having these questions. As I read them I could not help but wonder if there wasn’t a better way to dispose and protect property than get into these family squabiles and unpleasantness. Do you have any thoughts.

Thank you,

JR

Rania Combs

September 18, 2015 at 5:42pm

Hi JR,

Obviously, having a properly drafted Will or Trust will allow you to dispose and protect your property. Also, the following article may address your question: Don’t Keep Your Heirs in the Dark.

Thanks for your question.

Rania

Vickie

September 18, 2015 at 4:43pm

My live-in boyfriend of 5 years just passed away and didn’t have a will. He lived with me in my home for a year before we got into the house we currently live in. My name isn’t on the deed/mortgage to the home and I’m worried that his family is now going to kick me out of our home. I have two kids from a previous marriage and don’t want to be surprised by anything. What rights if any do I have?

Rania Combs

September 18, 2015 at 5:18pm

Dear Vickie,

Please accept my condolences for your loss. I’m sure this is a very difficult time for you.

When someone is single and dies without a Will, assets they own will be distributed according to the intestacy statutes. The intestacy statutes are rigid and will not take into account the fact that you had been boyfriend and girlfriend for five years. While they may seem neither fair nor equitable, without a will, the intestacy laws control.

Once again, I’m very sorry for your loss.

Erica

October 20, 2015 at 7:55pm

My mother and father both died without a Will. They owned a home. I had 4 siblings but one passed away recently. We want to sell our parents home. Will my deceased sibling’s children get her share of the house? Or is it split between the living siblings?

Rania Combs

October 26, 2015 at 11:48am

The descendants of the deceased child will inherit that portion of the property to which their parent would have been entitled if that parent were alive.

MM

October 20, 2015 at 10:53pm

What if a man and woman were legally married but they hadn’t lived together in years? Does that change the spouse’s legal rights if one spouse left years before and maintained another address?

Rania Combs

October 26, 2015 at 11:46am

No.

Em Riegel

October 21, 2015 at 7:49pm

My husband and I own our home, we both have two grown children we don’t have a will, who would get the house if one of us pass on

Rania Combs

October 22, 2015 at 12:49pm

If you are married and die without a Will, and you have children from another marriage, your spouse will keep his 50 percent interest in the community property, and your 50 percent community interest would pass to your children.

jerry

October 25, 2015 at 2:17am

My wife passed away and she has a son from another marriage. My home was a gift from my father in law. Just wondering what to expect if her son wants my home the deed is in my and my wife’s name and can I live in my home or do I have to sell ?

Rania Combs

October 26, 2015 at 11:12am

Dear Jerry,

The following article may answer your questions: Can Stepchildren Force a Surviving Spouse to Sell Homestead Property in Texas?

jerry

October 26, 2015 at 12:44pm

Thank you very much.

Mary

October 26, 2015 at 10:55am

My ex mother in law passed away. I was married to her son, and he passed away. She is survived by one son, his two children, and my two children. Are my children entitled to her estate if she had no will?

Rania Combs

October 26, 2015 at 11:07am

If a single person dies without a Will and has children, the intestacy statutes dictate that property will pass to her children in equal shares. If one child is deceased leaving descendants of his own, then the descendants of the deceased child will inherit that portion of the property to which their parent would be entitled if that parent were alive.

Corey

October 26, 2015 at 9:50pm

My mother passed away 4 months ago suddenly. She had no will and was married, but separated (not legally). She had inheritance money from her parents trust in a saving account and unfortunately did not have a beneficiary to the account. The heirs are my brother, my father, and me. Would her inheritance money be considered separate property or community property? Also, is her all of her personal belonging considered community property even if some of them were also inherited? Thank you for your time!

Rania Combs

October 27, 2015 at 8:46am

Please accept my condolences for the loss of your mom, Corey. The following article may answer many of your questions: The Characterization of Property in Texas.

John Carter

November 16, 2015 at 4:10pm

If your father dies and has just recently married before he died and left no will.does that automatically give her the right to half of the property because she married him. He bought the property before they were married. There are two of its kids and her. Thank you

Rania Combs

December 31, 2015 at 7:17pm

The following article may answer your questions: The Characterization of Property in Texas.

liz Cab

November 18, 2015 at 3:44pm

My brother passed away and his wife as well. They didn’t have any children together. I was wondering if her children are entitled to everything my brother owed. I know the property is under both names, please advise.

Rania Combs

December 31, 2015 at 7:14pm

Please accept my condolences for your loss.

When someone dies without a Will, their separate property and their share of the community property will pass according to the intestacy statutes.

Cathy

February 24, 2016 at 11:46pm

My husband passed away without a will. We have a mortgage that I am still making payments on. Are his children entitled to half of the house.

Rania Combs

February 26, 2016 at 6:01pm

Please accept my condolences for your loss. The following article explains how property is divided when a spouse in a blended family dies without a Will: The Complexities of Intestacy in Blended Families.

Ana Maria

March 22, 2016 at 1:23am

My father died, and his stepson sent a copy of my dad’s will dated 2007 saying that everything after his death is going to my father’s wife ( my mom died 11 years ago and dad remarried right away) . My siblings and I are not sure this is my dad’s last will. Is there any way to check on it? We live in TX

Rania Combs

March 23, 2016 at 9:55am

Probate is a court process by which a Will is proved to be valid or invalid. If you have reason to believe it is invalid, it is possible to contest the validity of the Will.

Debbie

April 5, 2016 at 3:24pm

Hi Rania,

My father passed away 2 months ago suddenly and without a will that we know of. He had recently remarried and bought a home with his new wife. The house is in both names. Am I understanding that she is entitled to live there as long as she likes but if she sells the house that my dad’s half of the profit from that sale with be divided between my sister and I? Does that also apply to a vehicle/boat? Thank you in advance for your help!

Rania Combs

June 16, 2016 at 8:11am

Please accept my condolences for your loss, Debbie. Property acquired during a marriage is presumed to be community property. Under Texas intestacy laws, if the deceased person was married but had children from another relationship, the deceased person’s one half interest passes to his or her children from the prior marriage and the surviving spouse retains her own share. However, a surviving spouse is entitled to a life estate in the homestead, even if it is the separate property of the deceased spouse and it was left to someone else. For more information read: Can Stepchildren Force a Surviving Spouse to Sell Homestead Property?

Tina Davis

April 19, 2016 at 5:33pm

If the mother of the children pass away, but is married, has 5 children but only the 2 youngest are the husband kids, who gets guardianship of the other kids?

Rania Combs

June 16, 2016 at 8:16am

If the three children are survived by their other parent, the other parent will be the natural guardian. If they are not survived by a parent, but the mother has signed an appointment of guardian, the person appointed will likely be the guardian, unless a court deems them unfit. Otherwise, a court will appoint a guardian for the children.

sylvia

May 10, 2016 at 6:03pm

My cousin passed away a month ago and left my mother a power of attorney for his stuff. Can she use the power of attorney to change the car title to her name in the state of Texas.

Rania Combs

June 15, 2016 at 10:47pm

A power of attorney expires when the person who created it dies. At that point, the executor or administrator takes over to settle the estate.

Mary

May 23, 2016 at 10:00am

My husband passed away 2 weeks ago. The company he worked for is asking for a letter of testamentary in order for me to receive his last check. He had a will drawn up years ago however he never signed it. Is there an easy and quick way to get that letter?

Rania Combs

June 15, 2016 at 10:37pm

Please accept my condolences for your loss, Mary. The following publication may answer many of your questions: The Texas Probate Passport.

Lisa Spinnati

May 29, 2016 at 10:18pm

My mom passed away Saturday morning. She has no will. It’s just me and my brother. I live in Ohio, and my brother in Indiana I don’t know what to do.

Rania Combs

June 15, 2016 at 10:33pm

Please accept my condolences for your loss. The following article may help: What To Do When Someone Dies in Texas.

Joan hughes

June 4, 2016 at 10:12am

My brother passed away with out a will. He was single, no children and no property, only a bank account. Do we still need to probate ? His sisters and brother agree to let it go to our mother. Are there any legal steps we need to take? Thank you.

Rania Combs

June 15, 2016 at 10:24pm

Please accept my condolences for your loss. The following article may answer your questions: Is Probate Always Necessary in Texas?

LRM

July 9, 2016 at 12:26am

My father passed away 7 years ago without a will but let family Know he wanted his home to go to me. My brother passed away before my father and his son (my nephew) signed away his rights to the house but my brothers daughter (my niece) passed away before she could (but after my father). She has 4 children who are minors. I want to sell the house, am I legally allowed to?

Rania Combs

July 9, 2016 at 12:09pm

Without a Will, the home will pass according to the intestacy statutes, which means that your niece’s children have an interest in the property. I recommend that you contact a probate attorney in your community for assistance with this matter.

Sarah

November 26, 2016 at 1:30pm

My husband died without a will because he assumed I would get everything. We have a house in both our names, two vehicles in both our names, one vehicle in only his name, and a lot of debt in his name only and in both our names.

Although when he applied for life insurance it said I was the beneficiary, when he made an alteration to the second beneficiary it appears there was a mix up and I was listed as executor and our five children, ages four through thirteen, were listed as as beneficiaries (5 children now ages 4-13.) What happens now?

Rania Combs

November 30, 2016 at 3:30pm

Please accept my condolences for your loss.

If your husband died without a Will, your property will be distributed according to the statutory formula described above. Non probate assets, such as life insurance and retirement plans, will pass to those designated as beneficiary.

Peggy Camper

November 28, 2016 at 2:32pm

If I have a hand-written will that is notarized, is it legal in Houston, Texas and would my estate still go into probate?

Rania Combs

November 30, 2016 at 3:23pm

To be valid, a holographic will must be written completely in your own handwriting, and signed by you. There is no requirement that it be signed by any witnesses. Having a Will does not avoid probate.

Tony

January 27, 2017 at 11:39am

Hello. My dad’s spouse passed away and she didnt have a will. They bought a home together, but she had 2 kids from a first marriage. It is my understanding that the kids get 50% of the estate and he gets to keep his 50%. Does he have to move out of the home and sell or can he stay as long as he wants? Can he rent it? One son passed away, but he had a daughter and she wants her portion. The other son didnt know he got a portion but now wants his portion. My dad has been living at this home for probably 20+ years

Rania Combs

January 27, 2017 at 11:55am

The following article may answer your questions: Can Stepchildren Force a Surviving Spouse to Sell Homestead Property?

Are Stepchildren Heirs in Texas --Texas Wills and Trusts

February 10, 2017 at 1:11pm

[…] Texas Intestacy statutes exist because the state thinks it is important that property be transferred in an orderly way after […]

Melissa

February 15, 2017 at 3:58pm

My mother passed away and I will be closing her bank account. Will I be taxed on the money I move from her account to my account? Her money is in an IRA and I would like to move it to my savings account.

Rania Combs

June 17, 2017 at 9:03am

I recommend that you speak with a financial adviser before cashing out an inherited IRA because there are potential tax implications of doing so.

Adrianna

March 17, 2017 at 3:52pm

My dad passed away with no will and left my grandmother as a beneficiary to his life insurance. Will this help with processing of the rest of his assets?

Rania Combs

March 23, 2017 at 4:04pm

Please accept my condolences for your loss. Unfortunately, the beneficiary designation on the insurance policy will have no bearing on the distribution of the remainder of a deceased person’s assets.

Eddie

May 11, 2017 at 3:55pm

Hi, What are the obvious benefits of having a will versus not having one in the event one dies? If one has no will and the state has to manage your estate, what percent of your estate goes to the state? Thank you

Rania Combs

June 17, 2017 at 8:58am

One of the biggest benefits of having a Will is that it allows you to choose how and to whom you want your assets distributed. If you don’t have a Will, your assets will be distributed according to a statutory formula. That does not mean, however, that the state will manage your assets or a percent of your estate goes to the state. It is only in rare circumstances when no heirs can be found that property will pass to the state.

Pam

May 16, 2017 at 5:17pm

My father-in-law has stage 4 cancer. My mother-in-law has been dead for 2 years. In his will, he left everything to her. He has never changed it. Will the 4 children get everything equally? And does the state get any of the assets? This is in Texas

Rania Combs

May 30, 2017 at 4:07pm

Wills usually identify contingent beneficiaries who will inherit if the primary beneficiary predeceases the testator. Those named as the contingent beneficiaries will inherit. The only time property escheats to the state is if a person dies intestate and has no heirs.

Shannon

June 17, 2017 at 9:48pm

My husband recently passed away. We own 2 homes, one we purchased together before we were married and the other one during our marriage. Is the house we bought before we were married community property or separate property? I am in Texas

Rania Combs

June 26, 2017 at 1:48pm

Texas subscribes to the inception of title rule, which bases the property’s character on the time and manner in which a person first acquires an interest in the property. If property is purchased before marriage, then it would be characterized at separate property. Property purchased during a marriage is presumed to be community property.

shari Prouhet

January 14, 2018 at 7:18pm

In relation to this question, my husband and I purchased the home we have lived in all of our marriage 9 months before the marriage but both of our names are on the deed to the home. Is it community property or seperate property for each of us?

Rania Combs

January 15, 2018 at 2:31pm

Property purchased before marriage is characterized as separate property.

Nancy

July 11, 2017 at 10:18pm

My brother recently passed away in Texas. He and his wife have been divorced for about a year. He has 4 siblings, no children and no will. Both of our parents are passed. If his ex wife is still the designated beneficiary on a savings account will she inherit the money?

Rania Combs

July 17, 2017 at 2:08pm

The Texas Estates Code provides that if after a decedent designates a spouse as a P.O.D. beneficiary on a P.O.D. account or other multiple-party account, the decedent’s marriage is dissolved by divorce, annulment, or a declaration that the marriage is void, the designation provision on the account is not effective as to the former spouse unless:

William

August 1, 2017 at 10:39am

Hi I have a question. My dad recently passed away, and the land that his home is sitting on was purchased when he and my mom were together. His new wife and stepchildren not willing to share anything that he had with me or even allow me to have just a few things that belonged to him. Do I have any legal claim to what he had since the land was purchased before he’s married to his new wife? I don’t believe he left a will.

Rania Combs

August 1, 2017 at 12:40pm

Property purchased before marriage is classified as separate property. Under the Texas Intestacy Statutes, when a married person dies without a Will owning real property that is characterized as separate property, the surviving spouse is entitled to only a life estate (the right to use the property until his or her death) in one-third of that property. The rest would be inherited outright by the children of the deceased spouse.

However, a surviving spouse has a constitutionally protected life estate in homestead property and cannot be forced to sell the property as long as he or she occupies and uses it.

Dolly

August 23, 2017 at 8:24pm

My husband and I have a two year old daughter, he also has a 28 year old daughter that is not mine, he is sick now with cancer and has not made a will, what will happen with all of our stuff

Rania Combs

August 24, 2017 at 5:15pm

The following article may answer your questions: The Complexity of Intestacy in Blended Families.

Lucy

August 23, 2017 at 8:28pm

In the state of Texas if a parent dies and has a child under age 18 and a child who is over the age of 18 and both have different mothers one whom has passed away do both children get the estate split equally or does everything go to the minor child

Rania Combs

August 24, 2017 at 5:13pm

When a single person dies without a Will and has children, all property will pass to his or her descendants. If all descendants are of the same degree of relationship, (meaning, for example, that all are the decedent’s children or all are his or her grandchildren), then the assets will be divided equally between them.

Paul

August 24, 2017 at 12:33pm

My brother passed away with no will (single, no children). My father passed away several years ago leaving just myself and my mother. However my father had children from a previous marriage that we have no contact with. Are my half siblings entitled to my brothers estate? What does the breakdown look like?

Rania Combs

August 24, 2017 at 5:09pm

The following article may answer your questions: What are the Inheritance Rights of Half Siblings When Someone Dies Without a Will?

Adam

August 24, 2017 at 2:47pm

Hi Rania,

Your site is full of great information!

My mother is an only child and her father passed away last year in Texas. His wife (my mother’s step mom) didn’t inform my mother until almost a full year later of his death. My mother and her father lost contact over the years.

What is my mother entitled too exactly? The stepmother had offered my mother $5,000 to take her name off some title so she can sell the home, but I feel my mother should be getting part of his personal property and part of the equity in their home. It was very strange, they only reached out to my mother when they needed something done, which I thought was very odd and a little fishy.

Again, thank you so much for your time.

Rania Combs

August 24, 2017 at 5:03pm

Hi Adam,

I’m glad you’ve found my site helpful.

When someone dies without a Will and has children from another marriage, one-half interest in the community estate will pass to the deceased person’s children, with the surviving spouse keeping only his or her one-half interest. With respect to separate property, the surviving spouse is entitled to one-third of the deceased spouse’s separate personal property and only a life estate (the right to use the property until his or her death) in one-third of the deceased spouse’s separate real property. The rest would be inherited outright by the children of the deceased spouse.

Dahlia

September 22, 2017 at 4:20pm

Hi Rania. My mother in law recently passed away. Right before her passing she and my husband had consulted a lawyer and were in the process of getting a p.o.a and will done, but she passed before anything was finalized. She did write down everything and signed it. What would be our best option to move forward knowing what she wanted done.

Rania Combs

October 11, 2017 at 9:34am

Please accept my condolences for your loss. I recommend you consult the attorney to determine whether the writing you mentioned would constitute a valid holographic Will. If not, the intestacy statutes would control the disposition of your mother in law’s property.

Jennifer

November 12, 2017 at 12:12am

My dad passed away two months ago and left a reasonable amount in the form of retirement and life insurance, but did not leave a will. Would my mom inherit all of the money or would my sister and I receive any? I only ask because she is not good with money and we want to set up a security account with our inheritance just in case she spends too much and needs emergency funds.

Rania Combs

November 17, 2017 at 3:58pm

Please accept my condolences for your loss.

Assets such as retirement plans and life insurance policies typically pass by beneficiary designations. If a beneficiary is identified, the proceeds of the retirement plan and life insurance policy pass to the named beneficiary rather than through a Will.

It’s always a good idea to consult a financial adviser after receiving an inheritance for sound financial advice.

Stephanie

November 15, 2017 at 6:37pm

Hi Rania. Thank you for this post and for very kindly assisting all of us trying to sort through the loss of a loved one. My father just recently passed away without a will in Texas. I am one of 4 siblings and my father is divorced. I understand that we, the heirs, are all entitled to 1/4 of his “estate” which only includes an old beater car and less than $5,000 in cash. Do we HAVE to file something? We are my father’s only 4 heirs and we are all united on how Dad’s assets will be divided so there won’t be any arguing between us over what remains. Should we file a Small Estate Affidavit? Or if we don’t file anything other than my father’s death certificate, is that enough?

Rania Combs

November 17, 2017 at 3:49pm

Dear Stephanie,

Please accept my condolences for your loss.

The following article discusses when a small estate affidavit can be used: When is it Proper to Use a Small Estate Affidavit? The article contains a flowchart to help you determine whether the small estate affidavit can be used in your situation.

David Lopez

December 28, 2017 at 6:24pm

Hello Rania, your website is so helpful. We live in Texas and this is our situation: my wife’s dad passed away 20 years ago and didn’t have a will. He owned several properties (one being his business shop) and a home which were all acquired while being married to my wife’s mom. Nothing was ever done about distributing his assets. Now we found out that her mom has given (as a gift) all properties, including the home, to my wife’s sister. Does my wife have a right to the properties and home? Can she claim that since their dad never had a will, she inherited part of the assets? Or were the assets all inherited by the mom and she is free to give them away? Thank you

Rania Combs

December 31, 2017 at 2:28pm

Thanks, David. I’m glad you find my website helpful.

Under Section 201.003 of the Texas Estates Code, if a married person dies without a Will, the entire community estate of the deceased spouse passes to the surviving spouse, if the surviving spouse is also the parent of all the deceased spouse’s children.

Rene Wimmer

January 4, 2018 at 4:56pm

Hi Rania

My mother-in-law moved in with my wife and I 7 years ago. She moved here from VA and divided her belongings with her 3 daughters. My wife, one of the 3 siblings, was her POA. My mother-in-law recently passed leaving basically nothing except enough money to bury her and her clothing. She died intestate. Will we still need to file an SEA with the court?

Rania Combs

January 11, 2018 at 2:10pm

The following article may answer your questions: Is Probate Always Necessary?

Ted Brown

January 11, 2018 at 2:16am

In Texas, if my wife and I die, with no children, and both of our parents are alive, how are our assets handled if we don’t have a will?

I appreciate your help!!!!!

Rania Combs

January 11, 2018 at 1:38pm

When someone who dies without a Will is married but does not have any children, the surviving spouse will inherit all property classified as “community property.” With respect to property classified as “separate property,” the surviving spouse would be entitled to all the separate personal property; however, if the deceased person has surviving parents and siblings, the surviving spouse would only be entitled to one-half of the separate real property with the other half passing to the parents, siblings or descendants of siblings in a manner set forth by the statutes.

Ruth A. McLaughlin

February 15, 2018 at 12:47pm

Hello Rania, I am in the situation that you note above, my dear husband of 26 years died a little over a year ago and he did not leave a will. It was just not a discussion that either of could have at the time. He did have a notarized POA naming me for all matters, medical, legal, assets, as well as, all financial concerns. We didn’t have alot but he had a truck, motorcycle, and minimal Texas oil rights, that should be dealt with. I am his only wife, no children of the marriage. He was an only child, even though his mother raised a 2nd cousin as her daughter. His mother and father are deceased. Is there a legal action (probate) that I must take to establish ownership of his property, or how do I get the items in my name? Thank you for any guidance that you might offer. Ruth

Rania Combs

February 23, 2018 at 7:03pm

Hi Ruth. I’m sorry for your loss. The following publication from the Texas Young Lawyers Association may answer many of your questions about the probate process: The Texas Probate Passport.

Clay atkinson

January 12, 2018 at 2:39am

If my father went to a lawyer and made a will out, but he hasn’t finalized it. If something was to happen before he finalized it, what would happen to his belongings? He has remarried, has no separate property, and has three kids.

Rania Combs

January 12, 2018 at 1:16pm

When someone dies without having executed a valid Will, that person’s property will be distributed according to the intestacy statutes.

Jason

January 24, 2018 at 3:11pm

Thanks for this site. It cleared up some info for me. Here’s my situation.

My sister was married with 2 children (both from the same father). She died without a will. However, I have beed raising them since before my sister died. I have guardianship, but the father still has parental rights.

From your article above, it says that her husband should inherit all her community property. Does that apply if he has not attempted to ever make contact or support his children? They are both under the age of 18, and I hope that some of my sister’s property would go to her children.

Thanks for any guidance.

Rania Combs

January 31, 2018 at 5:20pm

The intestacy laws are rigid and inflexible. They don’t take into account your unique circumstances and may dictate that your assets should be distributed in a way you would not have chosen

Vanessa

January 29, 2018 at 5:24am

My dad is divorced and I am the only child. He tells me everything that is his will pass on down to me automatically. Is this true? He didn’t put my name as a beneficiary for this reason.

Rania Combs

January 31, 2018 at 5:12pm

Under the intestacy statute, if a single person dies and is survived by children, the children will be his heirs. However, title does not vest automatically in the heirs. For example, if a deceased person owned real property, probate would be required to transfer title to the heirs, unless the deceased person had previously executed a transfer on death deed. Assets such as life insurance proceeds, IRAs, retirement accounts pass outside of probate to the listed beneficiaries

Justin

February 5, 2018 at 5:21pm

My dad passed away with no will. He and my mom have a house in both their names, which they still owe. Me and my two sisters want her to keep the house. Because there is no will do we still have to probate? If yes, can we just go to the county clerk office a file for probate and let the judge give mom the house? None of us would contest it, we want her to have it. That’s the only estate he had. We live in Texas. Thanks!

Rania Combs

February 7, 2018 at 4:14pm

The following publication from the Texas Young Lawyers Association provides some information about how the probate process works, as well as some simplified methods of administering an estate: The Texas Probate Passport(pdf).

Diego Tarcisio

February 7, 2018 at 2:12pm

Hi Rania ! Congratulations for you website! Excellent work !

See if you can help me.

Me and my wife are Non-Resident Aliens. I opened an account in a U.S. Brokerage firm (Joint Tenant With Rights of Survivorship). If one of us die, Which laws would be applicable to the estate ?

When I opened the account I was forced to indicate one American state but it wasn´t clear why, and I think it´s because legal questions like this one I´m presenting. I indicated the Texas State.

Thank you very much

Rania Combs

February 7, 2018 at 4:06pm

When spouses own property as joint tenants with rights of survivorship, a deceased spouse’s one-half interest automatically passes to a surviving spouse upon death, regardless of the intestacy statutes.

Bevelyn

February 9, 2018 at 11:13pm

Hi Rania I’m just reading all the comments to get some idea I love your site it will help me a lot.

My husband passed away recently. We don’t have a will our house is under our names. Do I need to probate it? We have 3 cars and 2 cars are under his name how can I sell the cars.

Hope you can help me thanks.

Rania Combs

February 23, 2018 at 7:15pm

I’m sorry for your loss, and I’m glad you find my website helpful. The following publication from the Texas Young Lawyers Association may answer many of your questions: The Texas Probate Passport.

Melinda Russell

February 16, 2018 at 10:40pm

My ex-husband died without a will. However, I have an old will from when we were married. Is this will still valid?

Rania Combs

February 23, 2018 at 7:00pm

Divorce does not invalidate a Will; however, the Texas statutes provide that if, after making a will, the testator’s marriage is dissolved, either by divorce, annulment or a declaration that the marriage is void, all the provisions in the will, including all fiduciary appointments, shall be read as if the former spouse predeceased the testator

Tonya

March 8, 2018 at 2:04am

Hi. Your website is very nice and has a lot of info. This is a great thing. My situation is my step mums only son died without a will. He has two children and his mum. She was there when he passed. She took care of him while he was sick money wise. Now that he’s passed, she’s saying that his children are entilted to all assets. Is the anything she can do? The children live in another state.

Rania Combs

March 23, 2018 at 9:37am

The Texas intestacy statutes dictate how property is to be distributed when someone dies without a Will. If a single person dies without a Will and is survived by children, then all property will pass to the descendants.

Jr

March 12, 2018 at 1:52pm

Hi Rania, I came across your page and you have very helpful information. I have a question, I got married to my spouse in 2005 and purchased a home in 2007 but my name is the only one on the deed. 2 years ago we separated and I was recently awarded full custody of my children. I plan on getting divorced but do not have all the money at this time. I would like to write a will stating if anything should happen to me I would like for my children to keep the home and anything else that is under my name. When their mother left the home 2 years ago she took everything in the home and sold it including the things that belong to our children. This is the only reason I would like to insure that my children inherit whatever I leave to them. Thank You for your time and response in advance.

Rania Combs

March 23, 2018 at 9:30am

A Will allows you to dictate how your property will be distributed after you die.

Stacy Francois

March 21, 2018 at 3:32pm

My step father passed away recently without a will. He has 1 daughter prior to marriage and 2 step children from his current marriage. His birth daughter is wanting her half of all his stuff, even though they didn’t have a relationship. Is she actually entitled to half or because of the other 2 children is his half divided into 3 parts one for each child?

Rania Combs

March 23, 2018 at 8:58am

When someone dies without a Will, the intestacy statutes dictate how their assets will be distributed. According to the intestacy statutes, stepchildren are not heirs. The following article explains: Are Stepchildren Legal Heirs in the State of Texas?

clifton

March 26, 2018 at 3:30pm

if your adopted by your step dad 40 years ago, can you still receive half of your biological fathers estate after he has been deceased for 13 years?

Rania Combs

April 9, 2018 at 10:22am

The following article may answer your question: Can An Adopted Child Inherit From His Biological Parents?

Dave

April 15, 2018 at 5:54pm

Thanks for the help Rania!

Wife of 32 years expired with no will in Texas. Most accounts have POD which is good. One decades-old at little local branch of small bank seems to be a problem. Account opened after marriage, several bank changes ago. No children. Seems obvious to me, but bank wants “Letters of Testamentary”. Do I have to go get court to declare it is community property?

Rania Combs

May 30, 2018 at 12:11pm

Pleas accept my condolences for your loss.

Community property does not automatically pass to the surviving spouse at death, which is why the bank is asking for verification that you have the authority to collect the funds on behalf of the estate.

Michelle

April 19, 2018 at 9:50am

I moved from ND and live in Texas currently. I am a resident of Texas and had my will done in ND. Do I need to redo my will?

Rania Combs

May 30, 2018 at 11:55am

The following article may answer your question: Is the Will I Signed In Another State Valid in Texas?

Noah

May 5, 2018 at 11:12pm

My husband passed away without a will. He has 2 sons and I have 2 daughters before marriage. Can I make a will and entile all of the properties to my childrend only? I want to ensure that my children inherit whatever I leave to them.

Rania Combs

May 29, 2018 at 5:23pm

A Will gives you the right to distribute of your separate property and your share of community property to anyone of your choice.

Amber U.

June 14, 2020 at 2:39am

I do hope you consider HIS children in your will if you make one. After all sounds like the property you own may have come partly from him to begin with, therefore the right thing to do would be distribute some of the property you received from his death to his children. I understand that they received a portion when he passed but you also received from him. Just a thought.

Amy

May 19, 2018 at 11:21am

Hi Rania, Three months after I married my husband his ex-wife died and his three children came to live with us. Six years later I adopted them and we added four children of our own. If he dies before me, will my adopted children have the same status as our children together or will they be considered my step-children? We do not have a will.

Rania Combs

May 29, 2018 at 5:15pm

Hi Amy. The Texas Estates Code provides that for purposes of inheritance under the laws of descent and distribution, an adopted child is regarded as the child of the adoptive parent or parents, and the adopted child and the adopted child’s descendants inherit from and through the adoptive parent or parents and their kindred as if the adopted child were the natural child of the adoptive parent or parents.

Lyn

June 21, 2018 at 4:31pm

Hi Rania, I am a second wife in Texas,and my husband has a child. He will give me no idea what is in his will. I am not sure if he even changed his will. I am concerned about my future if he dies. What are my rights as a second wife and what’s happens if his child dies before I do? Sorry I can’t give more information but I am unable to get it. Thanks for your assistance.

Rania Combs

June 26, 2018 at 11:29am

The following article may answer your question: Can I Disinherit My Spouse in Texas?

LULU

August 1, 2018 at 9:41am

My mom passed away suddenly and left no will, She is legally married but separated for the last 54 years she has 5 children. Will her Property go to her children?

Can any of her Children try selling property with no ones consent?

In Texas

Rania Combs

August 10, 2018 at 6:12pm

When someone dies without a Will, property is distributed according to the statutory formula. The statute does not make special provisions for married people who are separated. For purposes of the statute, they are married.

John Juanopulos

August 27, 2018 at 6:47pm

My father in law passed away without a will and has separate property. Is my mother in law entitled to all his property which is only one house?

Rania Combs

August 28, 2018 at 9:49am

When someone dies without a will, his separate property will be distributed according to the terms of the intestacy statutes.

Diana

December 21, 2018 at 2:29am

Hi my father in law just passed away a month ago. My husband was his only child. He was married to a woman who is not my husband’s mother. Who gets his stuff? They live in Texas and have no will!

Rania Combs

January 2, 2019 at 5:23pm

Please accept my condolences for your loss. The following article describes how property is distributed when someone dies without a Will in Texas: Dying Without a Will in Texas.

The intestacy statutes apply to probate assets. Assets that have beneficiary designations or POD/TOD designations pass to the designated beneficiary. Likewise, assets held with rights of survivorship pass to the surviving joint owner.

Kim

December 25, 2018 at 4:42pm

My husband of 5 years owned a house prior to our marriage which I understand makes it separate real property even though we used community funds to pay the mortgage. No children. I understand I receive 1/2 and his parents receive half. However, they want to evict me…do I have life estate use?

Rania Combs

January 1, 2019 at 10:35pm

Certain constitutional protections are available for surviving spouses in Texas. A surviving spouse is entitled to a life estate in the homestead and cannot be forced to sell the property as long as he or she occupies and uses it.

Diana

January 14, 2019 at 11:40pm

My dad did not leave a will. However, he got married to my mom 5 years after buying the house. We are a total of 5 children. Will i be able to transfer the house to my mom?

Rania Combs

January 16, 2019 at 11:15am

Property purchased before marriage is characterized as separate property. If someone dies without a Will, the deceased person’s estate will be distributed according to the intestacy statutes as outlined in this article.

Christine Ellis Mills

June 3, 2019 at 4:42pm

I am an only child from my Dad’s 1st marriage to my mother who is deceased. My dad died without a will. Am I entitled to 50 percent of his estate same as the suriving spouse?

Rania Combs

December 2, 2019 at 2:38pm

When someone dies without a Will leaving a surviving spouse who is not the parent of all the deceased spouse’s children, the deceased spouse’s 50% interest in community property passes to the children of the deceased spouse, and the surviving spouse retains his or her 50% interest in the community property.

Rose

January 25, 2019 at 2:16pm

Hi and good day,

My father passed away with no will in Texas and my younger brother and I are to be his beneficiarie. What do we need to do, paperwork that is , in order to have 80% of the benifits to go to my brother. Thank you so kuch for your help.

Rania Combs

December 2, 2019 at 2:42pm

The intestacy statutes provide that if an unmarried person dies without a Will in Texas and is survived by children, the children will inherit in equal shares. Heirs of an estate can disclaim their interest in property, or can gift the inherited property in any way they choose.

Pedro

April 21, 2019 at 12:02am

Main question “How is property divided in Texas?” My mom and dad are considered common-law married; my mom passed 8 years ago and my dad passed 2 years ago and they purchase a home together. Now that they are both deceased how is property divided between and my 3 half-sisters all who are from my mom’s first marriage and me (the only child from my parents?? please provide insight in known. thx.

Rania Combs

April 24, 2019 at 4:05pm

In Texas, when a married person dies owning community property, the surviving spouse will inherit all community property if the children are also the children of the surviving spouse. Otherwise, the deceased spouse’s one-half interest in the community estate will pass to deceased spouse’s children in equal shares, with the surviving spouse keeping only his or her one-half interest.

When a single person dies leaving children, then all property passes to his children.

Reema McMullen

May 17, 2020 at 10:26pm

My husband and I have one child together and He has two kids from a previous marriage. I understand that in Texas, if he passes then I get 1/2 and all three kids get 1/2 divided equally. What I don’t understand is what happens if I die first without a will? Does he get to keep 1/2 and then other 1/2 goes to child we have together or does it go to all three of his kids or he gets to keep it all as all three kids are his biological kids?

Rania Combs

May 18, 2020 at 12:11pm

If a married person dies intestate, and all the deceased spouse’s children are also the children of the surviving spouse, then the deceased spouse’s share will all pass to the surviving spouse.

Brandy Clanton

August 21, 2019 at 3:18pm

I have a question. My husband died a few years ago, I didn’t know about the laws of intestate succession until now. We were from NY. We lived and he died in Texas. He didn’t get along with his kids nor talked to them in over 20 years. Is there a statute of limitations for them to claim an inheritance? They lived in a state where the spouse receives everything so they do not know he did not have a will at passing. Please advise.

Rania Combs

December 2, 2019 at 2:36pm

Please accept my condolences for your loss. There is no statute of limitations for them to claim an inheritance.

Lala King

October 2, 2019 at 8:37pm

Hello, my father recently passed away without a will. He had a bank account and did not leave anyone for pay on death. He is currently married to my mom and had only one child in the marriage (me). However, he was in a previous relationship before her and had two children with a different woman but the previous relationship did not end in marriage. They are not around and are even in a different state than what he passed away. They were not around for years but are now asking about a will now that he has passed away. I’m just wondering because they are children not from his current marriage; does the intestate divide differently or can all of it goes towards my mother considering I am the only child of their marriage?

Rania Combs

October 14, 2019 at 10:37am

Please accept my condolences for your loss.

Under Texas laws, if the deceased person is survived by a spouse and children from another relationship, all the deceased spouse’s one-half interest in the community estate will pass to the deceased spouse’s children, with the deceased spouse keeping only his or her one-half interest.

THELMA MEERHEIM

November 24, 2019 at 6:52pm

I am the power of attorney over my oldest brother and I was wondering if I should get him to get a Will made before he passes. He has no kids.

Rania Combs

December 2, 2019 at 2:34pm

A will can help him dictate how he wishes his property to be distributed after he dies. Without a Will, the Texas Intestacy Statutes will control how the property will be distributed.

greg

January 27, 2020 at 5:04pm

My wife has four daughters from another relationship and passed away June 8 2018 with no will.We have a house worth about 200k and owe 55k on the house. I tried to sell the house and found out about some Texas law that her children get half of the house…even though I’m the one that has paid on it. Somebody else told me they get half of the house but only if they help pay the Tax, insurance, and part of the house payment from the day she died. I’m confused. Why should give away half of some they paid zero into? Two if her kids I get along with and two we dont speak….

Rania Combs

February 1, 2020 at 8:37pm

Please accept my condolences for your loss.

When a married person dies without a Will, the Texas intestacy statutes control how their property will be distributed. Under Texas laws, if you are married and are survived by a spouse and children who are not also yours, you get to keep your one-half interest in the property, with the deceased spouse’s share of the property passing to her children.

A surviving spouse also has a constitutional right to reside in the homestead for the term of his life, despite the children’s remainder interest in half the property. The following article discusses the rights and responsibilities of life tenants in Texas: What are the Rights and Responsibilities of a Life Tenant in Texas?

Bob

February 20, 2020 at 10:19am

Hello, and thank you for your this excellent article. My divorced sister recently passed away in Texas. She did not leave a will. Our parents are deceased, as well as one other of our sisters. There is just my one sister and I left. She has three adult children, and the other deceased sister has two adult children. Will the estate be divided equally between myself and my remaining sister, or will it be divided with the 5 nieces and nephews? My widowed brother in law from my deceased sister seems to believe he will receive 1/3 of the estate.

Rania Combs

February 20, 2020 at 4:55pm

If an individual dies unmarried leaving no children and has no surviving parents, then the estate is distributed to that individual’s siblings, with a deceased sibling’s share passing to the deceased sibling’s descendants, if any.

MYRNA GASC

March 9, 2020 at 11:02pm

My brother passed away without a will, my mom was the administrator and she is a widow. She signed an affidavit saying my brother had no siblings. Now the property is entirely in my mom’s name in Harris county, Texas. Is there a way I can stop her from selling it or someone else inheriting it and make my 50 percent valid?

Rania Combs

March 13, 2020 at 11:12am

An affidavit is a sworn statement. The legal consequences of lying in a sworn statement can be significant. I recommend that you engage a lawyer with physical offices in Harris county who can meet with you in person to discuss the best course of action in light of the circumstances.

Bob

April 8, 2020 at 11:25pm

My sister passed away in 2018 and did not have a will. She has four siblings one of which she gave a power of attorney. The sibling with the power of attorney transferred all of her assets into his name and has taken possession of them without conferring with the other siblings. In Texas is there a requirement for a probate hearing to determine how her assets be distributed?

Rania Combs

April 9, 2020 at 3:00pm

The power of an agent under a power of attorney expires when the principal dies. The estate of a person who dies without a will is distributed according to the Texas Intestacy Statutes.

Rachael F.

April 20, 2020 at 2:20am

I have a question about legal rights on a broke down vehicle and general personal goods. My mother’s best friend whom was in our lives and lived with out family off and on for almost 40 yrs, died . He was a estranged from his children and x wife. They never divorced though.nonetheless , do they have right to any of his stuff even though they were estranged and they are just being vultures? He truly wanted none of his things to even be given to them and everything stay with the people he lived with. Do the people he lived with have legal right to his things then?

Rania Combs

April 20, 2020 at 10:47am

The intestacy statutes are rigid and inflexible. They don’t take into account a deceased person’s unique circumstances and may dictate that assets be distributed in a manner the deceased person would have never intended.

Allison Miesner

April 25, 2020 at 12:16pm

Hi. My mother passed away two years ago. She bought a house with my father over 19 years ago and didn’t leave a will. Her name is still on the mortgage and my father is in the process of selling the house. I was wondering if my brother and i have any rights to the house. We live in texas and my brother i still live in the house at the moment.

Rania Combs

May 13, 2020 at 11:37am

Under Texas statutes, if a deceased person was married and is survived by a spouse and children, the surviving spouse will inherit all community property if all the children are also the children of the surviving spouse.

Amber

April 28, 2020 at 12:29pm

Hello, my ex-husband and I are still very good friends. We have 3 minor children together. He does not have a will. He does have a girlfriend but they are not married. He owns a home which is not fully paid off. My question is if he passes away, what would happen to his home? I believe his property would all go to the 3 children, correct? But how would this work since they’re all minors and the house isn’t paid off? Would it be possible for me to buy the house from them and put the equity that they earn from the sale in a trust of some sort that they would get when they turn 18?…not sure if that would work since they’re currently minors and I’m not sure if minors can sell a house…

Rania Combs

May 13, 2020 at 11:35am