Wall Street Journal Illustrates How Death of Estate Tax May Cost Heirs More

NB: This article was published on March 5, 2010 and contains information that may be outdated. For current information regarding the estate tax, read: Estate Tax Certainty…For Now.

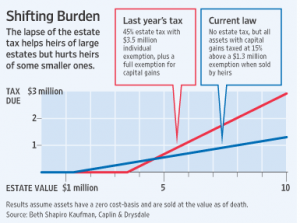

In an article entitled “Why No Estate Tax Could Be a Killer,” the Wall Street Journal illustrated how the death of the estate tax may cost heirs more.

The article compared the how two fictional widows with the same asset would fare under this year and last year’s tax laws.

One widow, identified as Ms. Bentley, had total assets worth $20 million, while the other, Ms. Subaru had total assets worth $2 million. Each owned some stock which had been purchased for $10,000 and was now worth $110,000.

Last year, Ms. Subaru’s heirs would not have incurred any taxes on the sale of the appreciated stock because her estate was worth less than $3.5 million. However this year, Ms. Subaru’s heirs would owe $15,000.

Despite the fact that Ms. Bentley’s estate is worth ten times more, Ms. Bentley’s heirs will also pay $15,000 on the sale of the appreciated stock, whereas Ms. Bentley’s estate would have incurred $50,000 in estate taxes last year.

The article concluded that those with estates valued between $1.3 and $4.8 million will actually pay more taxes this year than the would have paid before the estate tax was repealed.

Comments